![]()

Taking a politico-historical perspective to frame Greece’s fiscal crises

posted 16 May 2010 by moderator Ι. Fatsea

Our generation (less than 40 years old) has no memory of a credit crises. Many of us don’t recall what happened 10 years ago, nor have a faint idea of what was the US Savings & Loan crises (early 1980’s,) or the Asian economic meltdown. (1997) Both were very serious crises that plagued the world, and much larger than the Greek stock market crash following the casino economy of the late 1990’s.

The over exageration of today’s Greek fiscal crises [1] – has the form of scapegoating – for there has been a much newer financial calamity plaguing the advanced western economies. How can Greece, that constitutes around 2% of the European economy, and has state borrowings that makes up roughly 0.8% of the $36 trillion global government bond market [2] be the focus of concern on the world’s financial pages for the last 5 months? Of course this exagerated Greek debt side show helps distracts us from the more pertinent issues of our time. Even so, it also plays into the hands of the bond speculators allowing them to move the sovereign CDS market.( i.e. credit default swap trading on european sovereign debt - more on this later)

If we were to follow this debate further, the cause of concern would be the lack of fiscal constraints - in the ever increasing United States government debt, totalling around $12 trillion. [March 2010] Today this equates to roughly 33% of the $36 trillion global government bond market. But this is another story.

The plight of Greece is merely a continuation of an age old problem, long plagued by our Hellenic nation, that deals with human nature, the degeneration of politics, and the role of international finance – in that order.

In essence: the Greek financial crises was driven - by breaking the trust we have placed upon Greek government institutions, a number of senior bureaucrats, and the financial press. The predatory lending and institutional irregularities in the United States (the center of world finance) is another and separate aspect.

The 2008 US credit crises may still prove the start of a worsening systemic crises. The financial problem is far bigger than what has been reported primarily because there are too many dominoes lined up behind Greece.*

Contrary to media reports, the combined American and European governmental measures taken to date [3] have only stabilized the situation, NOT solved it.

The point I put to the forum was that there is still no light at the end of the tunnel because deleaveraging (paying off loans,) industry restructuring, and recovering from the devaluation of private assets, has only started for a time period that will take many years – not months.

Unsustainable spending

Owing to the nature of globalization, the western advanced economies have over the last couple of decades embraced common political and economic philosophies* that have guided the western world. Western politicians and social engineers principly embraced Keynesian economic policies* – as an excuse to encourage entire countries to live beyond their means. The world’s 3 most serious states are testament to this - the United States, England, and Japan. And a host of smaller advanced states [4] like Greece have only mirrored this pattern.

The use of financial market mechanisms for political ends

The recent changes in the world economy also have a political dimension.

The governor of the Bank of England Mervyn King in a recent interview [5]

[12 May 2010] wants to convince the world that the European debt situation is unsolveable.

As an international banker who rarely talks, King used this crises to his best advantage, so as to suggest that the only way to solve Europe’s debt problems is to do away with national budgets. The European Union must “become a federalised fiscal union” he says. Thus implying that there should be only one central European authority to tax and spend. Another noteworthy turn of events.[6]

Taking aim at restructuring and posterity

The drum beat we constantly hear in the news about the dreaded state of Greece’s financial problems has erroneously NOT been put into proper context.

Kenneth Rogoff former IMF chief economist, had accurately described in the Japanese press how Greece had failed to embark upon a restructuring program to strengthen its financial house, in reaction to the 2008 sub-prime triggered credit crises plauging the world. Using an analogy Rogoff explains:

There’s an old joke about two men who are trapped by a lion in the jungle after a plane crash. When the first of them starts putting on his sneakers, the other asks why. The first answers: "I am getting ready to make a run for it." But you cannot outrun a lion, says the other man, to which the first replies: "I don't have to outrun the lion. I just have to outrun you!"

Greece was late to put on its sneakers, while other troubled countries, such as Ireland, Spain, and Italy had raced ahead with earlier fiscal short-term adjustments.

But the longer term fiscal situation is the underlying problem of most of the world’s advanced economies. Even the Bank of England governor King admitted, against consternation, that “the United States faces the same problems as Greece.” [12 May 2010] see link here

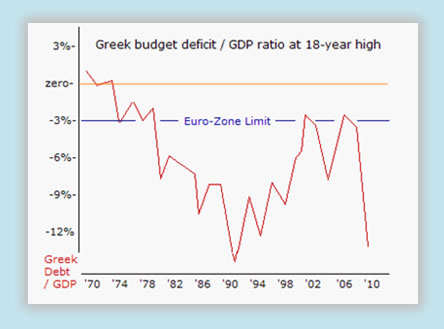

It is also said that Greece was “late to put on its sneakers” because of the internal political division of the country. Which leads me to a serious point of contention: the political class could have been forced to avoid this mess if there had been a continuous reminder that Greece’s fiscal spending far exceeded what it can afford; and what was at stake was the ever increasing cumulative debts the politicians were leaving its children. There is no excuse for neglecting our posterity, and the diagram (below) attests to the Greek government’s 36 year fiscal clown show since the mid 1970's.

[2] figures sourced from the International Swaps & Derivatives Association

[3] the fiscal problems similar to Greece are common across many European countries; and this is why European finance ministers were forced recently to decide on a EUR 750 billion rescue package [May 2010]

[4] Greece as part of the 33 advanced economies using the International Monetary Fund definition “advanced economies"

[5] Bank of England press conference 12 May 2010

Governor Mervyn King - verbatim interview

[6] also see Jacques Attali New York Times op-ed Feb. 2010 "Greece was the birthplace of Europe. And the Greek crisis will, in the end, be the midwife of the completion of the European project.”